Unlock Your Dream Home with a Mortgage Broker

When it comes to securing the best financing for your home, choosing a mortgage broker can be one of the smartest decisions you'll make. At SouthernILMortgageBroker, we specialize in connecting you with the right lenders, helping you navigate the often complex world of mortgages. Dive into the various advantages of partnering with a broker, and see why this choice can make all the difference in achieving your dream home.

Expert Guidance Tailored to You

Personalized Service Every Step of the Way

One of the most significant benefits of working with a mortgage broker is the personalized guidance they provide. A mortgage broker will take the time to understand your unique financial situation and homeownership goals. This tailored approach ensures that you are not only matched with the right loan products but also receive advice that is specifically suited to your needs, making the entire process smoother and more manageable.

Access to a Wider Range of Loan Products

More Choices Than Traditional Lenders

Unlike traditional lenders who may only offer their own products, a mortgage broker acts as an intermediary, giving you access to a variety of loan options from multiple lenders. This means more choices for you, allowing for better rates, terms, and options that suit your financial goals. Ultimately, this breadth of choice can save you both time and money.

Negotiation Power

Better Rates and Terms

Mortgage brokers have established relationships with many lenders, which can enhance their ability to negotiate the best possible rates and terms on your behalf. They understand the nuances of the market and leverage their knowledge to find you favorable conditions that might not be available to you when going directly to a lender. This negotiation prowess can lead to significant savings over the life of your mortgage.

Smoother Application Process

Streamlining Your Journey to Homeownership

Navigating the mortgage application process can be daunting, but a mortgage broker can streamline it for you. They will assist you in gathering the necessary documentation, filling out paperwork, and ensuring that all requirements are met. Their experience minimizes the chances for errors and delays, allowing you to focus on what truly matters – finding your new home.

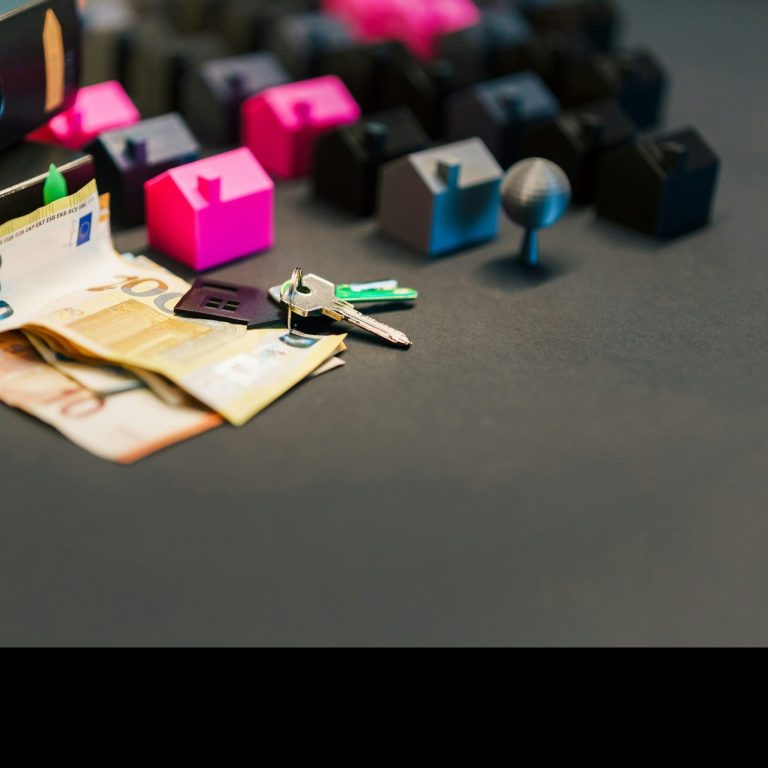

Discover Your Perfect Loan with SouthernILMortgageBroker

At SouthernILMortgageBroker, we understand that every financial journey is unique. That's why we offer an extensive variety of loan options tailored to meet your specific needs. Whether you're a first-time homebuyer, looking to refinance, or seeking investment properties, our team of mortgage experts is here to guide you every step of the way. Explore the different loans we provide to find the perfect match for your financial situation.

Conventional Loans: The Solid Choice

Conventional loans are a popular choice for homebuyers looking for competitive interest rates and flexible terms. With options for both fixed and adjustable rates, our conventional loans can be adjusted to suit your monthly budget. Let us help you secure a loan that aligns with your long-term financial goals.

FHA Loans: Making Homeownership Accessible

FHA loans are designed for those with lower credit scores or smaller down payments. These government-backed loans allow you to achieve your dream of homeownership with ease. SouthernILMortgageBroker specializes in catering to applicants needing flexible criteria to ensure homeownership is within reach.

VA Loans: Honoring Our Veterans

VA loans provide incredible benefits for veterans, active-duty service members, and certain members of the National Guard. Enjoy no down payment and competitive rates, designed to support those who've served our country. Our team is dedicated to helping you navigate the VA loan process smoothly.

Jumbo Loans: For Your Dream Home

If you're looking to purchase a high-value home, jumbo loans provide the solution. These loans exceed the limits set by conventional loans and offer flexibility for luxury real estate purchases. SouthernILMortgageBroker can assist in securing a jumbo loan that aligns with your unique ambitions.

Understanding Your Mortgage Needs: Credit vs. Down Payment

When it comes to securing a mortgage, two of the most critical factors to consider are your credit score and your down payment amount. At SouthernILMortgageBroker, we understand that navigating these requirements can be overwhelming. That’s why we are here to clarify these essential aspects and help you assess your financial position effectively. Let’s dive into whether good credit is paramount and what a 20% down payment could mean for your home financing journey.

The Importance of a Good Credit Score

Is Good Credit Necessary?

Your credit score plays a vital role in determining your mortgage options and interest rates. Generally, lenders prefer borrowers with good credit scores, as this indicates a lower risk of default. With a solid credit history, you not only increase your chances of loan approval but may also qualify for better terms and lower rates. However, don't despair if your credit isn't perfect; there are still options available to help you secure financing with guidance from our knowledgeable mortgage team.

Understanding Down Payments

Why is a 20% Down Payment Significant?

In the world of mortgages, a 20% down payment has become somewhat of a gold standard. Making a substantial down payment can decrease your loan-to-value ratio, which may ultimately result in lower monthly payments and potentially better financing terms. Additionally, many lenders may waive Private Mortgage Insurance (PMI) for loans with a 20% down payment, saving you even more money in the long run. However, it’s important to explore all available options and find a requirement that fits your financial goals.

Alternatives to a 20% Down Payment

Can You Secure a Loan Without It?

While a 20% down payment is often ideal, it's not the only path to homeownership. Many programs exist with lower down payment requirements, including FHA loans and VA loans, which can help you secure financing without the burden of a hefty upfront cost. At SouthernILMortgageBroker, we specialize in connecting you with products tailored to your unique circumstances. Let us help you find the right loan solution, even if you can't put down 20%.

The Balance Between Credit and Down Payment

Finding Your Perfect Fit

Determining whether you need good credit or a 20% down payment is not a one-size-fits-all scenario. Your individual financial situation, background, and goals will influence which option may serve you best. The experts at SouthernILMortgageBroker are dedicated to walking you through your choices, helping you understand how credit scores and down payments interplay in the mortgage approval process. Together, we can create a strategy that sets you up for success on your journey to homeownership.

Ready to Transform Your Experience? Discover What We Offer and Let's Begin Your Journey Together Today!

Telephone: 618-919-1768

E-mail: tyson@grovescapital.com

Address: Metropolis, IL 62960

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.